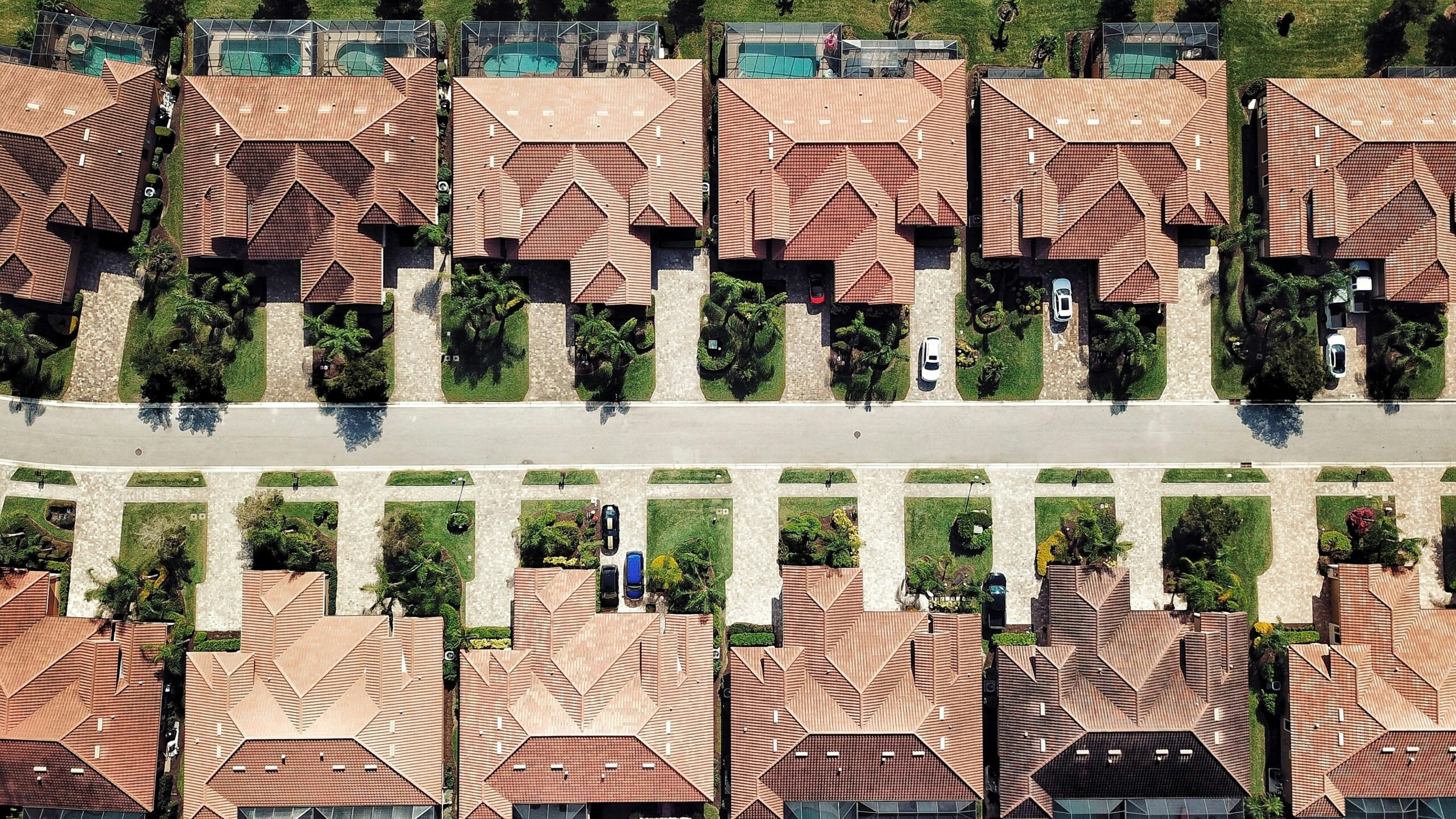

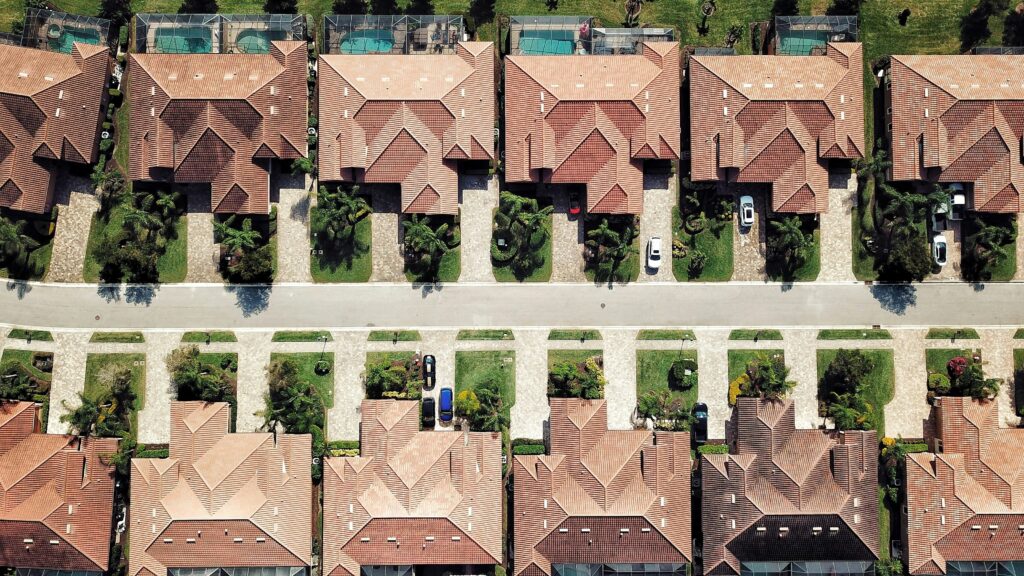

Tips for Refinancing Real Estate

Refinancing real estate means getting a new mortgage with terms that are more beneficial for the borrower than those of the current mortgage. When refinancing your home or property, there are several things to keep in mind as you start the process.

- What is the reason for the refinance? You may be looking to lower your monthly payments, for reduced interest rates, change the duration of your loan, or access the equity in your property. Determining why you want to refinance will assist in the process.

- Check your credit score for errors and, if your score is low, work on fixing it. Your credit score directly impacts your interest rate for the refinance loan.

- Determine the amount of equity that you have in the home if you want cash from the refinance. Home equity is the difference between your home’s market value and what you owe on your mortgage, and you can “cash-out” on that equity by refinancing.

- Get estimates of closing costs for the refinance. Closing costs are generally 3-6% of the total refinance loan amount. Shop around as the closing costs can vary.

- Be organized and respond quickly to the lender’s requests. This is one benefit to using an attorney when you refinance; they will help you throughout the entire process.

Although using a real estate attorney to help you refinance your home isn’t required, it may actually save you money in the long-run. They can ensure that you aren’t being overcharged or overlooking any fees, the loan terms are in your best interest, and you aren’t being scammed. For more information about how Cona Law might help you refinance your property, click the button below.